- What Is a W-2 Form definition?

- Additional Requirements on W-2 Tax Form

- W-2 Tax Form Parts

- Form W-2 Instructions

-

- The First Part — General Details

- The Second Part — Tax Payment Details

- The Third Part — the State Tax Payment Details

- W-2 Form 2024: Terms and Requirements

- File Templates in Electronic PDF Format

- Keep Track of Deadlines

- Check Everything Twice

- Attach a Copy of the Form to any Tax Return Documents

- Pay Taxes Quarterly

- Don't be Afraid to Correct a Mistake

- Keep all Records in Each Employee's File

- Register Online With the Social Security Administration

- Hire a Qualified Accountant to Avoid Mistakes

- Use the Software or an Online solution for Storing Documents and E-filing

What Is a W-2 Form?

The W-2 form is one of the most frequently used forms by taxpayers. Taxpayers also know it by another definition — the Wage and Tax Statement. This document is filled by an employer for their employees. Being quite short in size, the form is still very informative and extremely important for taxpayers as the data it contains is used to complete tax return forms.

Additional Requirements on W-2 Tax Form

The form should be filed in several copies. One of them goes to the employee, the second to the Social Security Administration and the third to the local state tax department. The last three copies stay with the company so that all forms are kept in either paper or digital storage for four years in case of tax audit. The Social Security Administration reviews W-2s to be informed of employee payments. Providing the wrong information can lead to problems with both the IRS and SSA, so make sure you have provided the correct, up-to-date and relevant information.

To avoid these types of problems, make it a rule in your company that employees have to inform you about any changes to their address, legal name, marital status, etc., as soon as possible. This way you will have the most accurate details for every employee so that all corporate documents can be completed correctly. Remember, that the form is filed by officially hired individuals only. The independent contractors, who are meant to provide their services to the company but are not employed, file forms with another tax return. Those individuals should carefully track their payments, as only they are responsible for reporting them to the local IRS department.

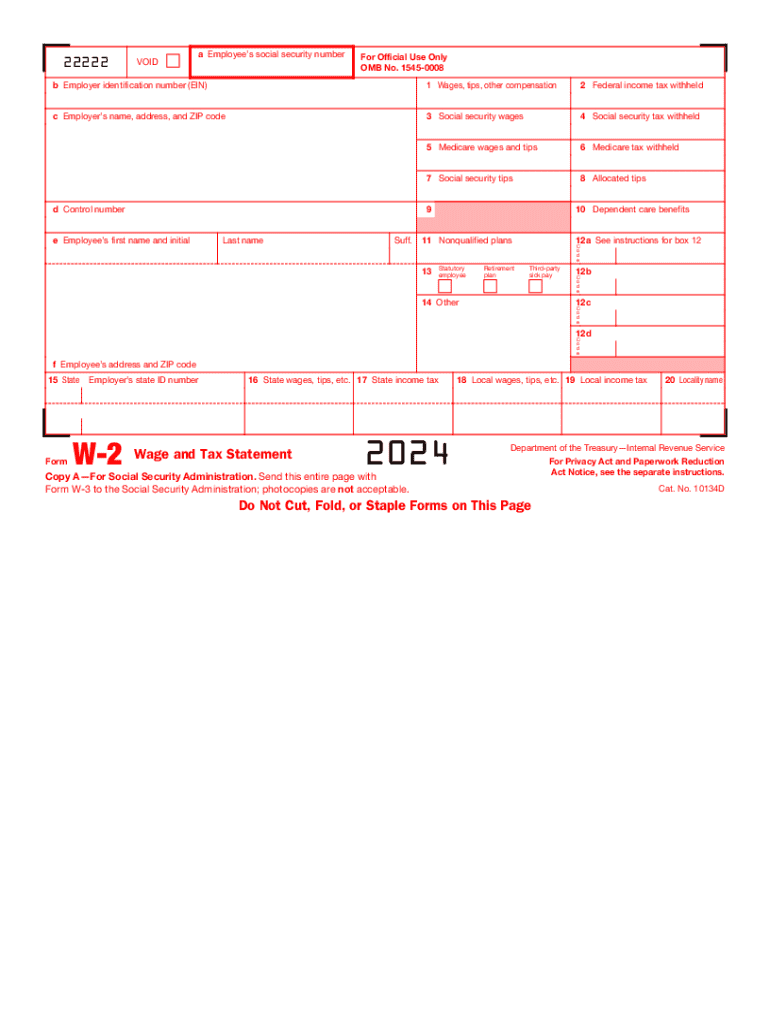

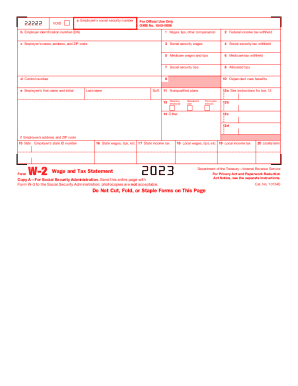

W-2 Form Parts

Before you begin filling out the form, let's take a closer look at its components. We highly recommend that employers speed up the filling process by using the template with fillable fields. The form contains general information about the employer and employee and tax payments with the withdrawal sum in particular. It may seem complicated due to having numerous small boxes that are not easy to work with. We will explain the items that the sample contains for everyone who deals with form W-2. Let’s take a closer look at what details the employer should include about the company:

- The full name of the business or company.

- Complete office address with the ZIP code.

- Correct Employer Identification Number.

- The State ID Number and control number (needed for record-keeping purposes).

The employee’s details include their first and last names with initials together with full mailing address and ZIP code. The part containing taxes is more complicated and is subdivided into a number of separate cells, itemizing general and particular payments and tips. We’ll take a closer look below.

W-2 Instructions

In particular, every item in the W-2 tax form has its own name for better navigation inside the form. The document contains three main parts.

The First Part — General Details

The left part includes the following details about the company and the hired employee:

- cell a - Employee’s Social Security Number. It is important to provide the correct number as mistakes can lead to delays in tax report acceptance.

- cell b - Employer Identification Number.

- cell c - Employer’s or company’s full official name, address and ZIP code.

- cell d - Control number, assigned by the payroll processing system, used in your company.

- cell e - Employee’s full name, last name and initial.

- cell f - The postal address of the hired person, including their state, city, street and ZIP code.

The Second Part — Tax Payment Details

The second part consists of itemized financial information boxes:

- 1 — includes tips wages or any other compensation.

- 2 — contains the federal income tax withheld.

- 3 — is for Social security wages.

- 4 — Social Security tax withheld, counted on the employee’s behalf.

- 5 — Medicare wages and tips, that may be used to report in the 8959 form like additional Medicare Tax.

- 6 — Medicare tax withheld. The sum is 1.45 percent on the whole sum of Medicare tax withheld. If those tips increase by 200,000 dollars, an additional tax is used.

- 7 — Social Security tips, to record the income reported by the employee to the employer.

- 8 — Allocated tips - separate from items one, three, seven or five. Those tips are better counted when filing the 4137 form, check the amount from there.

- 9 — Verification code, used by those who file the template electronically and should contain only numbers and letters from A to F. With it, the IRS can better identify the data submitted while filing your return.

- 10 — Dependent care benefits. If the employee has children or dependents, it is important to include the number of payments in this cell. If they increase to five thousand dollars, they should be reported in the first box.

- 11 — Non-qualified plans. This box is used for those who get non-qualified deferred compensation. If the individual had both distribution and deferral for one tax year, they are not provided here.

- 12 — Deferral status for the Internal Revenue Service. It may be used for elective deferrals, designated Roth contributions plans and simple plan deferrals. There are a number of codes used in the concrete case. Thus, read the form instructions carefully in order to use the most applicable code for the employee. It may be more than one category.

- 13 — Tax payment plans, including the status of an employee, retired person or third-party sick pay.

- 14 — Report any additional information, not applicable to any box. This can be the state disability tax withheld, non-taxable income, health insurance premiums, uniform payments etc.

The Third Part — the State Tax Payment Details

The bottom of the form is used to provide details about state taxing:

- 15 — the employee’s state ID number

- 16 — State tips, wages

- 17 — Income tax withheld, paid to the state budget

- 18 — Local tips, wages and other payments

- 19 — Local income tax amount

- 20 — Locality or city name where the taxes are paid.

The last part is applicable to the employer only, as the company pays taxes not only according to the general tax law but also to the local state budget. Business laws may vary from state to state, that is why it is important to provide this information for the place of your business.

Form W-2: Terms and Requirements

Be sure to review the general requirements and tips used to file the W-2 form. Below is a list of recommendations for your consideration.

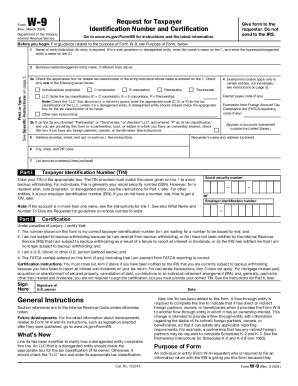

File Templates in Electronic PDF Format

The general requirements for a W-2 tax form. Send it to your employees as well as governmental and state institutions by US mail or by electronic mail. It is also possible to complete the sample electronically and print it on a blank piece of paper. Those who have many employees, more than two hundred and twenty, are required to file the form digitally, as it is much easier for the IRS to process numerous electronic documents than paper copies. Additionally, e-filing will save you time and the templates are easy to review thanks to the printed text format. With this printable sample, W-2 submission form will be generated automatically by the Social Security Administration.

Mind any Deadlines

It is obligatory to complete and send all samples for the previous tax year before the thirty-first of January. This way you and your employees will avoid penalties and misunderstandings with governmental institutions. First, send documents to the Internal revenue Service to avoid paying penalties. The minimal late-file amount is fifty dollars per each form that is filed late, but was sent in thirty days after the deadline. Those who file later than in the month period after the due date will have to pay one hundred dollars for every sample. Forms filed later than the first of April will be the most expensive, in the amount of two hundred and sixty dollars per every employee. In this way, the amount of penalties may vary from $ 536,000 to $3,218,500 for large companies and from $187,500 to $1,072,500 for small businesses. That is why we kindly ask you to complete all tax documents on time. For employees, you had better send samples at the beginning of January. If some mistakes are discovered there or an employee fails to receive their copy, you will have time to clear up any misunderstandings.

Check Everything Twice

Remember that every single item provided in the form should match all other documents. In case you have some differences, the IRS will want to know the reason for them, due to the possibility of additional checks and penalties. Those who do not manage to provide tax information, especially for tips, will be obliged to pay the highest tax rate. Do not add dollar signs in the fields with sums and use black font while completing the fillable sample. Mind that it is important to include decimal points as well as cents. Any information provided incorrectly may also be reason for incurring penalties. If there were any circumstances, not under your control, that influenced the templates to be filed incorrectly, provide evidence to the IRS.

Attach a Copy of the Form to any Tax Return Documents

For you to prove the information in the tax samples, you need to provide the samples together with any supporting documents and a W-2. Mind that if an employer does not provide the form to you on time, it is important to request it by sending a request for the document to your company’s office.

Pay Taxes Quarterly

Do not leave your payments till the last moment. Instead, you can subdivide them into smaller parts to give yourself a lower financial and paper load. Businesses should file numerous docs per every financial year, that is why you should simplify your document management. Careful tracking and paying of taxes in smaller portions reduces difficulties and confusion.

Don’t be Afraid to Correct a Mistake

If you’ve noticed a mistake in a form after you’ve filed it, it is better to correct it and file a new copy, otherwise you may have problems in the future. Taking steps to correct the mistake proves that you knew about it and tried to correct it as soon as possible.

Keep all Records in Each Employee’s File

You may fail to send a document to a hired individual, as the contact information they provided may have been wrong. For receiving notifications by USPS or email, do not delete or throw them out. Keep them as proof that you did everything right from your side. Try to contact an employee and inform them about your case. Then, he or she should provide you with the correct information. In case you fail to connect with an employee, the notification will serve as adequate proof.

Register Online With the Social Security Administration

Users registered at this online-platform have the opportunity to not only e-file but also check tracking on reports you’ve provided. The system will show the application status and error reports (for example, if there is a mismatch in name and SSN). You can check if the W-2 form was submitted with this service as well.

Hire a Qualified Accountant to Avoid Mistakes

A company, even with more than fifty employees, will face problems during the tax season. The amount of information one person, not knowing a lot about processing payments, is extremely large. That is why it is much better to hire a specialist.

Use the Software or an Online solution for Storing Documents and E-filing

Reporting taxes withheld and filling forms online would be impossible without the use of the special tools, designed to accelerate the form-filling process and make it easy for everyone. Select the proper w-2 online tool or software you like and do not worry about withholding taxes anymore!